On the other hand, Japan legalized Cryptos in 2017. Chile and Canada have both had Crypto ETFs since early 2021, and even Brazil has 13 Crypto ETFs.

Crypto in the U.S.

In January 2024, the SEC finally approved BlackRock’s bid to create a Bitcoin ETF in the U.S., so the Crypto floodgates in the U.S. have started opening. Prior to that GrayScale had several “Investment Trusts” that allowed investors to buy various Cryptos but the fees were rather high and the premiums even higher. See: Applying the ROC to Crypto for more information.

Just today the Crypto news included:

- Oklahoma Passes a Bill to Protect Crypto Owner’s Rights

- Wisconsin Pension Fund Invests in Bitcoin ETFs.

According to Reuters, mainstream companies are investing in Crypto as well. In February, software firm MicroStrategy (MSTR.O), put about $155 million into Bitcoin, and Tesla, Block, and Coinbase, have collectively purchased hundreds of millions of dollars worth of Bitcoin. At one point, MicroStrategy CEO Michael Saylor said, he was buying $1,000 in Bitcoin every second.

As early as 2021, 13 of the world’s largest banks had already invested at least $3 billion into the $2 trillion cryptocurrency market, according to analytics company Blockdata. These banks included Standard Chartered, BNY Mellon, Citibank, UBS, BNP Paribas, Morgan Stanley, MUFG, ING, BBVA, Nomura, and Barclays.

These don’t sound like terrorist enterprises. They’ve seen the writing on the wall and don’t want to be left behind.

The Fight Against Crypto

But on the other end of the spectrum we have the SEC prosecuting multiple Crypto organizations that have been trying to get the SEC to codify regulations so they can actually have some laws to abide by. We also have the Netherlands sentencing crypto privacy developer Alexey Pertsev to 5 years in prison for developing an open-source tool that allows people to keep their crypto transactions private.

Almost every week lately, it seems there’s a new announcement that the U.S. Securities and Exchange Commission (SEC) has gone after yet another crypto company for alleged securities violations. Last year, the SEC claimed that the Cryptos Solana, Polygon, and Cardano are actually Securities under their jurisdiction.

Some of those the SEC is targeting are :

- Ethereum (the Second largest Crypto Chain after Bitcoin)

- Ripple (A Blockchain involved in DeFi)

– a Federal judge partially ruled in Ripple’s favor - Robinhood (a brokerage that opened a Crypto arm)

- Consensys (creators of a crypto wallet)

- Uniswap Labs

- Coinbase (one of the largest crypto exchanges)

- Binance (another crypto exchange)

- Kraken (another crypto exchange)

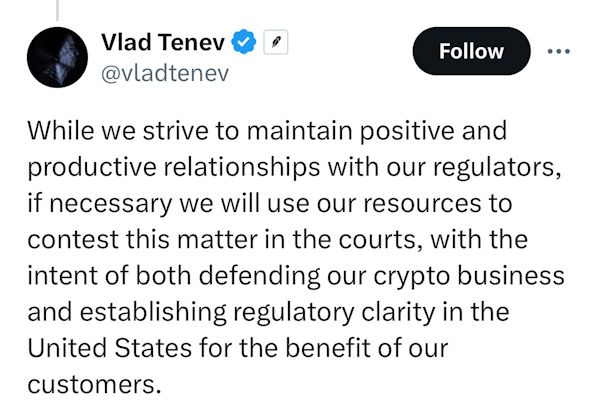

Vlad Tenev, Robinhood’s CEO, said in a post on X on Monday that the SEC was engaging in a “continued attack on crypto.”

In the last few weeks, crypto has become such a political football that some strategists believe that the (primarily young) crypto proponents could end up flipping the swing states Republican.

Cryptos Fight Back

Primarily Republicans but some Democrats as well in the U.S. Senate and House of Representatives are trying to reign in the SEC, but Biden has vowed to Veto the legislation.

Robinhood’s CEO vows to fight back:

But former CFTC Chairman J. Christopher Giancarlo said, “The global future is all of the above: crypto, CBDCs, stablecoins, and more.”

CBDCs are central bank digital currencies. Basically a CBDC is a government-sponsored crypto, that the government controls (and can inflate), which free market crypto proponents claim is the antithesis of true decentralized cryptocurrencies.

What Crypto Really is

Crypto is much more than just Bitcoin or even more than just a currency. It is a revolutionary jump forward. It is a combination of software, currency, open-source, and privacy.

Crypto does for finance what the internet did for communication. The Blockchain allows for Decentralized finance (DeFi) with virtually zero transaction costs. So it is no surprise that banks like JP Morgan Chase, Morgan Stanley, HSBC Holdings, Blackstone, Charles Schwab, Goldman Sachs, Citigroup and many more are involved.

But there is more to the blockchain than just finance. Forbes lists more than 50 major companies that are aggressively pursuing blockchain initiatives including, Microsoft, Alphabet, and Meta of course. But also Oracle, Intuit, IBM, Block, Shopify, and dozens of others.

Basically, a blockchain is just a list of transactions that anyone can view and verify. But that doesn’t mean they know who made the transaction. So, it is both public and private at the same time. This facilitates the secure transfer of payments without having to go through a third-party like a bank. And the transactions are almost instantaneous.

Blockchain technology is also exciting because it has so many uses beyond just cryptocurrency. Blockchains can be used in healthcare to explore medical research, securely store patient records, and ensure privacy. It can streamline supply chains and logistics, track goods, verify authenticity, and prevent counterfeiting. It can facilitate Real Estate transactions and title management. It can enhance insurance claims processing, fraud prevention, and so much more. You don’t have to worry about loss of data because the data is decentralized. Multiple copies of the blockchain exist on many, many machines. Old data can’t be modified (only updated), thus data among the various nodes can be compared, ensuring consensus, and preventing tampering, corruption, or loss.

Conclusion

A lot is happening in the cryptoscape both from a regulatory and an innovation standpoint. Crypto has the potential to revolutionize the world as much as the Industrial Revolution, transistors, computers, or the internet did. And it is still in its infancy. But it is still possible for regulations to try to strangle the infant in its crib. But if that happens in one country, the innovation will simply move somewhere where it is appreciated. This could be devastating for the economy of any country that gets this wrong and tries to stifle innovation.

You might also like:

- Applying the ROC to Crypto

- The Modern Day Wild West: Crypto Scams And Opportunities

- Crypto 2.0, A Whole New Ballgame

- What are NFTs and Why are They Going Crazy?

- How Blockchain’s Unique Innovations Can Prevent Money Remittance Scams

- How Is Technology Affecting Global Trading Markets

- Metaverse vs. Multiverse- What are They? And Where are They Leading

- Cryptocurrencies and Inflation

- Can Crypto Solve Venezuela’s Hyperinflation Problem?

- How has Venezuela’s Bitcoin experiment Fared?