Editor’s Note:

The following article is based on analysis from Robert Prechter’s Elliott Wave Theorist. For more detailed analysis from Robert Prechter, you can download the Free 75-page “Independent Investor” eBook from Elliott Wave International.

Death of the Dollar, Again:

Before You Mourn, See This Chart

By Nico Isaac

If you want the latest news on the U.S. Dollar Index, try a search under its new ticker symbol, RIP. — as in, “rest in peace.” Let the record show: In the early morning hours of Tuesday, October 6, the mainstream financial community officially declared “The Demise of the Dollar” (The Independent).

The “coroner’s report” cites these details as the causes of death:

An alleged (and later denied) secret meeting among leaders of certain Arab States, China, Russia, and France which aimed for the immediate discontinuation of oil trading in U.S. dollars.

And, an open statement from one senior United Nations official that proposed the dollar be replaced as the world’s reserve currency.

In the words of a recent Washington Post story: “The growing international chorus wants the dollar replaced… a move that would end the greenback’s six-decades of global dominance.”

And with that, the line between negative sentiment — AND — “EXTREME” negative sentiment was crossed. It occurs when the beliefs about a market lean so far over in one direction, that the boat investors are sitting in is about to tip over… Just like the last time.

Case in point: Spring 2008. The U.S. dollar stood at an all-time record low against the euro after plunging more than 40% in value. And, according to the usual experts, the greenback was “dead”-set to meet its maker. On this, these news items from early 2008 say plenty:

“The dollar is a terribly flawed currency and its days are numbered.” (Wall Street Journal quote)

“It’s basically the end of a 60-year period of continuing credit expansion based on the dollar as the world’s reserve currency.” (George Soros at the World Economic Forum)

“Greenback is losing Global Appeal… the ‘Almighty’ Dollar is Gone.” (Associated Press)

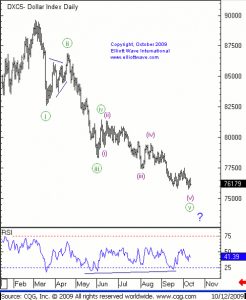

YET — from its March 2008 bottom, the U.S. dollar came back to life with a vengeance, soaring in a one-year long winning streak to multi-year highs. In the most current Elliott Wave Theorist (published September 15, 2009), Bob Prechter presents the following close-up of the Dollar Index since that trend-turning bottom. (some Elliott wave labels have been removed for this publication)

At a measly 6% bulls, the bearish dollar boat tipped over. The situation today is even more remarkable: The percentage of bulls is lower, at 3-4%, while the dollar’s value is higher than the March 2008 level.

It’s crucial to understand that markets don’t necessarily respond to sentiment extremes immediately. But, such extremes do indicate exhaustion of the trend — which is usually the opposite of what the mainstream expects.

For more information, download Robert Prechter’s free Independent Investor eBook. The 75-page resource teaches investors to think independently by challenging conventional financial market assumptions.

From Elliottwave International’s Forex Focus:

U.S. Dollar: Kiss Goodbye or Reversal at Hand?

It may seem extreme, but the October 12 headline on DrudgeReport.com (one of the world’s most popular news websites) “Kiss the Dollar Goodbye,” complete with a picture of a smooching President Obama, is a fair reflection of the sentiment toward the buck.

Based on a recent poll, bullishness towards the U.S. dollar is still low (17%) and has been as low as 3% on previous occasions. This reminds me of the sentiment towards crude oil in December 1998, when it traded just above $10/barrel. At that time prices had already fallen by half, and the almost universal opinion was that oil would go below $10/barrel. Price had to drop only 36 cents to get there — but it never happened.

The headline above plainly states what many business articles are saying. There are also rumors that the dollar will be replaced as the pricing currency — another example of extreme bearish sentiment. We’ve seen similar rumors in the past when negative sentiment towards the dollar would reach an extreme: in late 2004, for example.

All this bearishness continues to fit the Elliott wave pattern we see in the U.S. Dollar Index charts: Potentially completed five waves down since March 2009.

The dollar reversal could be a RARE opportunity. EWI’s Currency Specialty Service can help you catch it. 9 Currency Pairs, 24 Hours a Day. Get the latest forex forecasts now with Currency Specialty Service. Click here for details

Robert Prechter, Chartered Market Technician, is the world’s foremost expert on and proponent of the deflationary scenario. Prechter is the founder and CEO of Elliott Wave International, author of Wall Street best-sellers Conquer the Crash and Elliott Wave Principle and editor of The Elliott Wave Theorist monthly market letter since 1979.