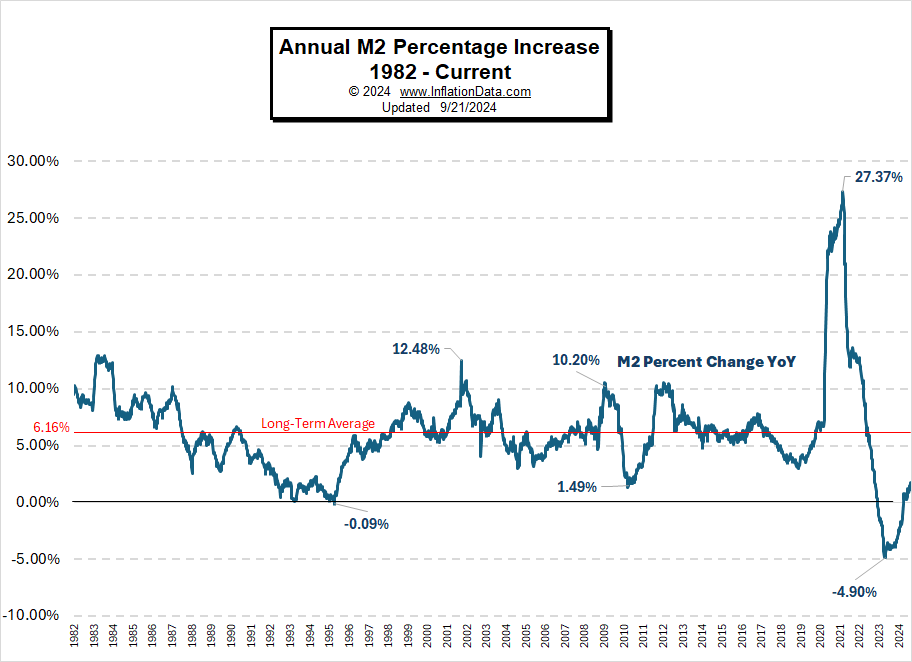

How Much is the Money Supply Growing?

The “M2 money supply” includes liquid assets such as Cash, Checking Accounts, Savings Accounts, CDs, etc.

Looking at the chart below we can see that the M2 money supply increased gradually for many years until the pandemic when it shot up drastically, and then in 2022 the FED significantly decreased the money supply for the first time. But over the last year or so it appears to be resuming its previous uptrend.

How Much is the Money Supply Growing? Read More »