From Ice Cream To Toilet Seats: The Most Bizarre Uses For Gold

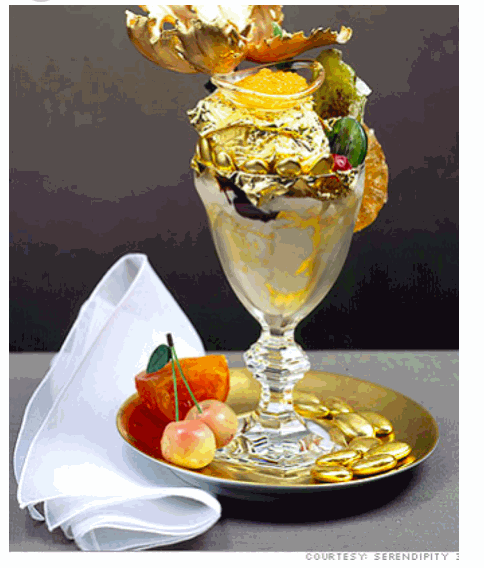

Since the days of Cleopatra, humankind’s desire to use gold in ever more bizarre ways seems to have grown stronger by the day, with food often the primary target of this creativity. Today, gold appears to have conquered cuisine, with everything from gold-covered ice cream, to gold tacos, Indian tandoori and even 24-carat-covered gold steaks.

From Ice Cream To Toilet Seats: The Most Bizarre Uses For Gold Read More »