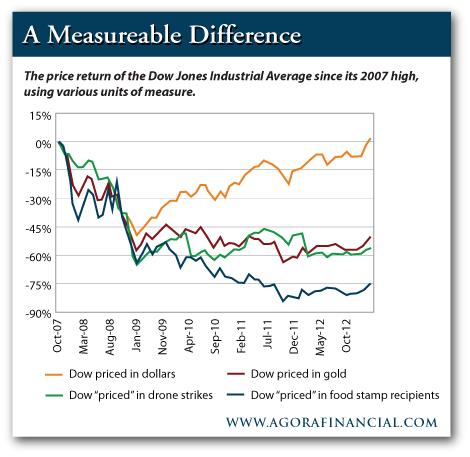

Obama’s Comments Worry Stock Bulls

Today Chris Ciovacco points to some other indicators that are beginning to turn negative. Of course, we are coming to the end of the summer doldrums and so we could see a reversal of fortunes as we enter the fourth quarter but we still have to make it through the notorious months of September and October. Remember the ROC has not issued a sell signal yet but just a preliminary warning.

Obama’s Comments Worry Stock Bulls Read More »