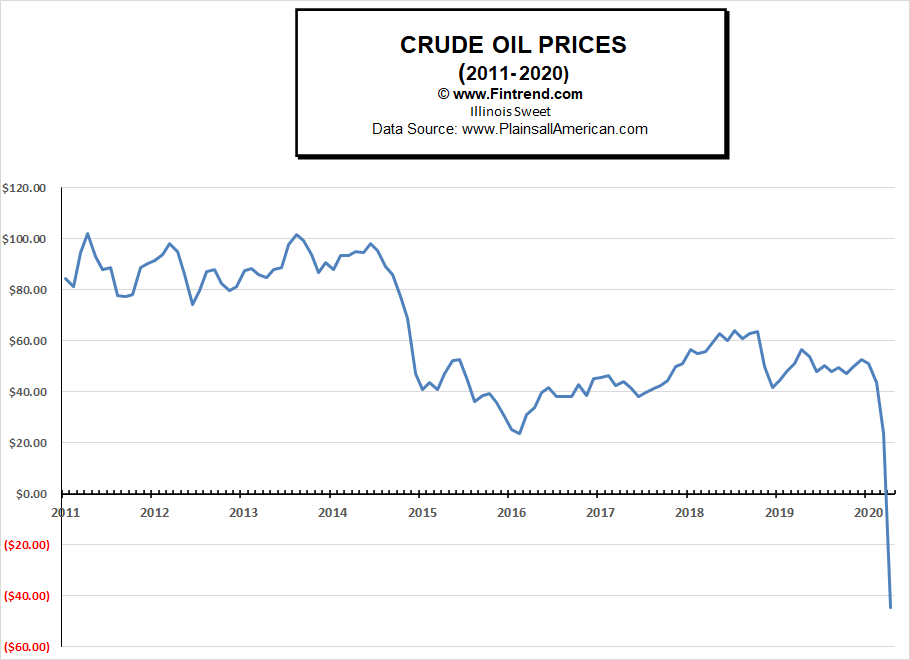

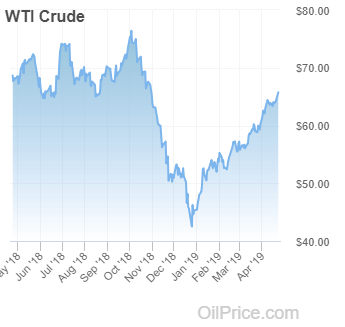

After years of improvements in drilling techniques and impressive “efficiency gains,” there is now evidence that the U.S. shale industry is reaching the end of the road on Well productivity.

A report earlier this month from Raymond James & Associates finds that the U.S. shale industry may be struggling to achieve further productivity gains. If these improvements begin to fizzle out, it could result in “an inflection point in future global oil supply/demand balances,” the investment bank said.

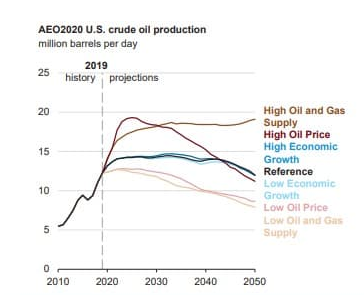

Oil well productivity is “tracking WAY below our model,” analysts Marshall Adkins and John Freeman wrote in the report. They note that U.S. oil production is up less than 100,000 BPD over the first seven months of 2019, compared to the 600,000-BPD increase over the same period in 2018.