Will Rising Bond Yields Send Stock Prices Tumbling?

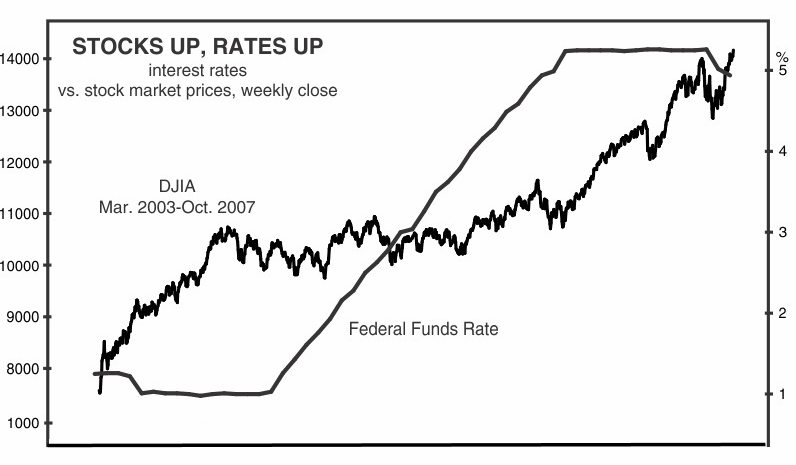

As you probably know, the conventional wisdom on Wall Street is that investors will sell stocks in favor of bonds when yields reach an attractive level. So, it’s not surprising that many pundits blamed the DJIA’s triple-digit decline on rising bond yields. Let’s put that belief to a test.

Will Rising Bond Yields Send Stock Prices Tumbling? Read More »