Asteroid Mining: Science Fiction or Science?

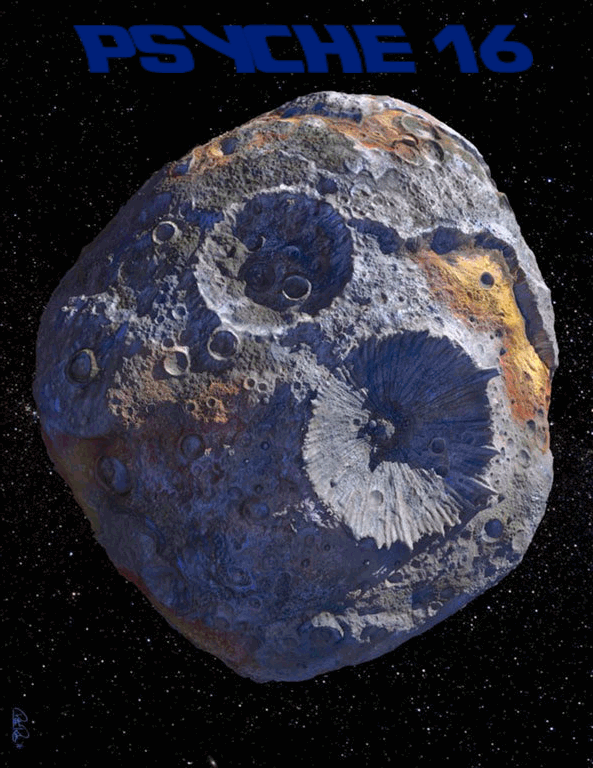

From the beginning of the genre of Science-Fiction, authors have dreamed of valiant spacemen and spacewomen (perhaps along with a few space pirates) venturing out into the asteroid belt and mining precious minerals and bringing them back to a mineral starved earth. As with other Sci-fi inventions like StarTrek flip phones um… I mean communicators… science might be catching up with fiction. In the following article, Joao Peixe of Oilprice.com makes the case for the feasibility of mining the asteroid belt coming soon to a spaceport near you. ~Tim McMahon, editor.

Asteroid Mining: Science Fiction or Science? Read More »