By Rusty McDougal

You know they are trying to accomplish this ignominious feat. The goal is to keep Americans in an economic stupor. It is working.

Lies and deceit are pervasive. Newspapers, magazines, TV broadcasts, economic analysis and official prognostications are all based on shady statistics. Junk in… junk out.

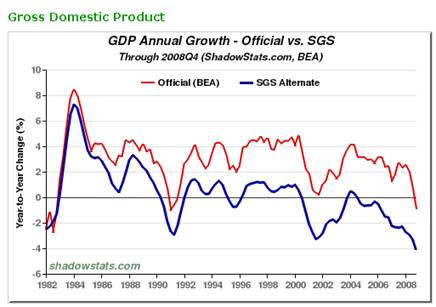

When you look closely at a chart of actual GDP you’ll see a resounding depression in the US the first decade of this century:

This chart is from www.shadowstats.com and tracks US economic growth the old fashioned way… the truth receives priority. The red line in this chart represents the official story and shows positive growth over the last 18 years with the exception of a recent plunge into negative territory.

The blue line represents the same data interpreted according to more reliable standards, well before the bubble blowers took steroids and the central planning helm. Yes, the stats have been doctored for 25 years. If the blue line doesn’t show a sustained recession (depression) I’d hate to see one. What’s even worse is that there is no end in sight to our economic malaise.

These lies are part and parcel of our presently crumbling economy. It simply matters more now that the wheels have completely fallen off.

Clearly, the US has had negative growth this decade with the exception of a brief period in 2004. Negative growth predominating over a nine year time frame rings up similarities to Japan’s “Lost Decade” of the 1990s. Japanese real estate and stock prices crumbled in 1989 and Japan’s bubble has been leaking air ever since. They imported central planning from the West and cling to it to this day.

In actuality, Japan’s economy grew about 1.5% per year in the 1990s if their numbers can be trusted. That’s a far cry from their post WW2 boom years, but also drastically better than the US’s present lost decade.

The word con is derived from confidence games. A consumer credit and debt based economy is a confidence game. Official stats have become a confidence game. Wall Street cheerleading is a confidence game. Treasury debt is a massive confidence game. The US dollar is the biggest confidence game of all.

You’ve been conned for decades. The swindle has gone down. The flim-flam men are setting up their next trick. Trusting and unwary citizens are lining up to participate once more. The population remains in a state of denial.

No, you can’t lie your way out of a depression! Nor can you borrow and spend your way out of one. The money being printed for crony bailouts and “stimulus” packages adds up to unfathomable amounts of debt. All that is stimulated in the end is the certainty of the days of default and bankruptcy.

The US is long past the point where a reasonable amount of debt can be taken on and have it result in a proportional productivity. Debt and over-leverage are the catalysts of our problems and there will be no real recovery until they are wrung out. One way or another they will be purged. There are natural laws of economics just like there are natural laws of science. Don’t confuse the Fed head with Father Economics.

Our manipulating officials can amp up the Dow for a smiley face 2000 points but this does nothing for the underlying economic and financial fundamentals. Be careful that you don’t fall for this trickery as corporate insiders are presently unloading stock en mass. What exactly do they know?

You must see through the ongoing distortions and protect yourself. Blow away the smoke and shatter the magicians’ mirrors. Participate in all the tea parties you like but nothing gets solved until the con men are run out of town.

Live Resourcefully,

Rusty

This investment news is brought to you by Investor’s Daily Edge. Investor’s Daily Edge is a free daily investment newsletter that is delivered by email before the market opens. It’s published by Fourth Avenue Financial, a subsidiary of Early To Rise (an affiliate company of Agora Publishing). In each weekday issue you’ll receive practical strategies for protecting your portfolio and multiplying your money. You’ll also learn about undiscovered opportunities in emerging sectors and markets, deeply discounted stocks, recommendations for bonds, cash, commodity and real estate investing, and top ETFs. To view archives or subscribe, visit Investor’s Daily Edge.