Many hurricanes today are best known for the loss of life they cause, but their impact is often much more all-encompassing due to the financial devastation that results from loss of property and income. Historically great hurricanes such as the Galveston Hurricane of 1900 or the Great Miami Hurricane of 1927 created such extensive financial losses at the time they hit, that the locations they struck took years to recover, or never recovered at all. Catastrophic risk analysts at Karen Clark and Company say that should a similar storm hit the same areas today, the amount of financial damage could be expected to climb into the tens of billions if not hundreds of billions of dollars.

Factors in Financial Losses of Hurricanes

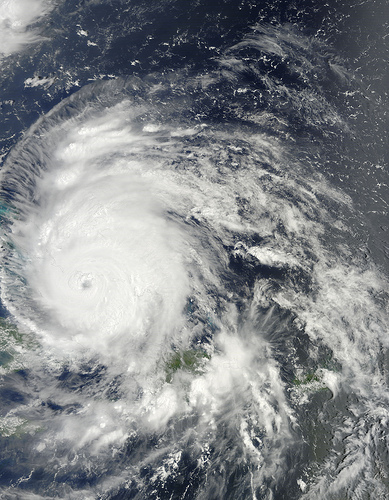

The reason that hurricanes like the Great Miami Hurricane would cause such extensive financial devastation if they struck today are numerous. The strength and duration of the storm are just two of the most obvious components of the equation. A hurricane that impacts a densely populated area also brings much more serious consequences, such as electricity outages, loss of employment, food shortages, not to mention the loss of life that can occur. These obvious factors are just part of the focus of studies recently done by Karen Clark & Company.

While populations along coastal areas throughout the Gulf of Mexico and the Eastern Seaboard have grown exponentially since the end of World War II, building codes, materials and construction methods have also undergone a dramatic change. Simply adjusting the cost of a historic storm by the rate of inflation between the year the storm struck and the current year isn’t enough, according to the risk analysts. The rise in building costs per square foot has outpaced the annual average inflation rate over the past 30 years by two to three percent, or sometimes even more.

Hurricanes of Early 20th Century Would Cause Billions In Financial Losses Today

The catastrophic risk analysts at Karen Clark & Company assessed hurricanes that hit the US between 1900 and 2011 to determine what the costs in 2012 dollars would be were the tropical cyclone to hit the area today. The Great Miami Hurricane, the Okeechobee Hurricane and the Galveston Hurricane are the top three storms listed according to their economic impact. According to their analysis, the Great Miami Hurricane of 1926, which hit the city on Sept. 18, would result in an estimated incredible $125 billion in insured losses. The Okeechobee Hurricane, which hit Lake Okeechobee in southern Florida two years later, and the 1900 Galveston Hurricane that struck the city on Sept. 13 both would bring in insured losses of between $50 and $65 billion today.

The Fort Lauderdale Hurricane of 1947 and the New England Hurricane of 1938, along with hurricanes Betsy, Hazel, Andrew and Katrina also are listed among the top storms that would lead to insured economic losses of at least $20 billion today.

Damage Assessments Revised for Hurricanes Andrew and Katrina

Hurricane Andrew, which struck just south of Miami on Aug. 24, 1992, has been reassessed using this method of catastrophic risk analysis. Andrew caused losses estimated at between $18 and $22 billion in 1992 dollars, according to reports. Today, the same losses would reach $50 billion. Hurricane Katrina, the most recent catastrophic storm to make the list, could cause an estimated $40 billion in insured losses today, according to risk analysis.

Karen Clark & Company determined that of the almost 180 storms that have hit the US coastlines since 1900, 28 would cause losses of over $10 billion. According to the analysis, hurricanes that can cause more than $10 billion in insured losses statistically are likely to strike the US coastline once every four years. The inclusion of these historic storms in risk analysis can help companies and insurers better assess the likelihood that catastrophic damage or destruction might occur at any specific location along the US Gulf or Atlantic coastlines and what the potential costs could be.

See Also:

- Hurricane Katrina: The Economics of Disaster

- Agflation- What is it?

- Sell My House Quickly

- Top 10- Nicest Affordable Cars

- Financial Planning is Essential for Survival

- Risky Business: 3 Reasons for Businesses to Have Insurance

- The Differences Between Term and Whole-Life Insurance

This article was composed by Ty Whitworth for the team at Comcast cable TV and cable packages; if there’s one effect of hurricanes which can be predicted, it’s that the cable goes out.

Photo Credits: By NASA Goddard Photo