What is a “Black Swan”?

According to Wikipedia… The phrase “black swan” was a common expression in 16th century London as a statement of impossibility. The London expression derives from the Old World presumption that all swans must be white because all historical records of swans reported that they had white feathers. After Dutch explorer Willem de Vlamingh discovered black swans in Western Australia in 1697, the term morphed to connote that a perceived impossibility might later be disproven.

Black swan events were introduced by Nassim Nicholas Taleb in his 2001 book Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets. His 2007 book The Black Swan: The Impact of the Highly Improbable extended the metaphor to events outside of financial markets. Taleb regards almost all major scientific discoveries, historical events, and artistic accomplishments as “black swans”—undirected and unpredicted. He gives the rise of the Internet, the personal computer, World War I, dissolution of the Soviet Union, and the September 2001 attacks as examples of black swan events.

Based on the author’s criteria: 1.The event is a surprise. 2.The event has a major effect. 3.After the first recorded instance of the event, it is rationalized by hindsight, as if it could have been expected; that is, the relevant data were available but unaccounted for in risk mitigation programs.

I’ve always thought of Black Swan events as being events that are so rare that they are unexpected. Often major market crashes only come once or twice in a lifetime, so everyone assumes they will “never” happen to them. In this article Chris Ciovacco talks about several possible Black Swan events, including the new FED head, a war in Syria, and Tapering. ~Tim McMahon, editor

Obama’s Black Swan

by Chris Ciovacco

Summers ‘Likely’ To be Named

My guess is many on Wall Street thought “no way” when they first heard the name Larry Summers mentioned as the possible next Fed chairman. Back on August 19 we made the argument that President Obama’s “artificial bubble” comments seemed to point to Summers, rather than Janet Yellen. From CNBC:

My guess is many on Wall Street thought “no way” when they first heard the name Larry Summers mentioned as the possible next Fed chairman. Back on August 19 we made the argument that President Obama’s “artificial bubble” comments seemed to point to Summers, rather than Janet Yellen. From CNBC:

A source from Team Obama told CNBC that Larry Summers will likely be named chairman of the Federal Reserve in a few weeks though he is “still being vetted” so it might take a little longer. It’s largely come down to a two-horse race between Summers, a former Treasury secretary, and Fed Vice Chairman Janet Yellen for the next Fed chief.

Tapering, Now This?

Wall Street has been so focused on the Fed’s probable bond tapering schedule that the early reports of Summers being a serious contender did not seem to register. Wall Street has spliced all the sound bites together from the past few weeks and the reality of a Larry-led Fed may be sinking in. From CNBC:

Speculation that Larry Summers is the favored candidate to take over Ben Bernanke as Fed chief has resurfaced in recent weeks, prompting a strong backlash from some industry watchers, with one going as far as labeling his potential appointment as a “black swan” event. “There is a lot to be said that the next Fed chair is going to be picking up a surgery in the middle of surgery, think of it that way—that’s very difficult to do – That could be the black swan that people aren’t expecting,” Bouroudjian, CEO of Bull and Bear Partners, told CNBC, referring to the difference between Summers and Bernanke policies.

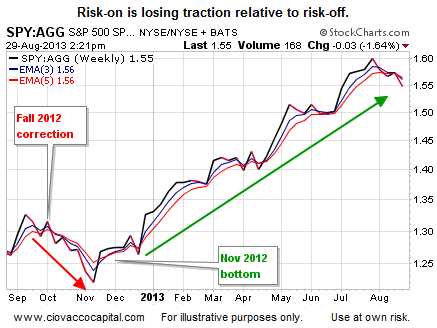

Janet Yellen is unquestionably the more market-friendly choice. The markets are beginning to morph into a “risk-off” stance as Yellen’s dream job is in question. The chart below shows the performance of stocks relative to bonds. When the ratio is rising, demand for growth-oriented stocks is greater than the demand for more conservative bonds. The ratio is taking on a concerning look similar to the October 2012 correction in stocks.

Military Strikes Tend To Spook Markets

Since rising oil prices can send negative ripples through the global economy, financial markets keep a close eye on anything that could potentially disrupt normal shipping and production patterns. Military action against Syria appears to becoming more likely by the day. From Reuters:

Obama told Americans on Wednesday evening that a military strike against Syria was in their interest following the gas attack and Britain said armed action would be legal, but intervention looked set to be delayed until U.N. investigators report back after leaving Syria on Saturday.The U.S. and its allies have “no smoking gun” proving Assad personally ordered the attack on a rebel-held Damascus neighborhood in which hundreds of people were killed, U.S. national security officials said.

Investment Implications

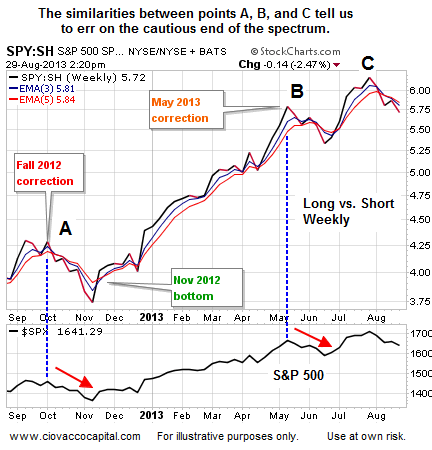

Our market model uses the chart below to help us answer the question, “Would I rather be long or would I rather be short?” Like the stock vs. bond chart we presented above, the long (SPY) vs. short (SH) ratio below is taking on a look very similar to the periods where stocks corrected in October 2012 and May 2013.

We have reduced risk on four separate occasions in recent weeks. If concerns about the Fed or military action spark further deterioration in the risk-on/risk-off ratios we track, we will continue to reduce our exposure to equities. In terms of adding some defensive positions to our portfolios, we will be watching the emerging relative strength in gold (GLD), bonds (TLT), and shorts (SH).