Living in the now is an important concept for both a happy life and also as an investment strategy.

The following article by Chris Ciovacco of Ciovacco Capital originally appeared here and has been reprinted by permission. ~Tim McMahon, editor

“Nothing has happened in the past; it happened in the now.

Nothing will ever happen in the future; it will happen in the now.” ~ Eckhart Toll

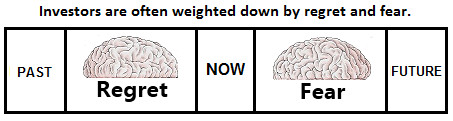

The Twin Thieves: Fear and Regret

Our entire investing lives have taken place in the now. We have never executed a buy order in the past, nor have we ever executed a sell order in the future. However, we have all wasted a considerable amount of mental energy thinking about the past or worrying about the future.

The Past Is Yesterday’s News

Investors cannot go back in time. Dwelling on the past can expend a tremendous amount of emotional capital that could be used to make sound and rational decisions in the present.

“Sometimes letting things go is an act of far greater power than defending or hanging on.”

Eckhart Tolle

No One Can Predict The Future – So Why Waste Time And Energy On It?

Since economic and market outcomes are based on the future actions of millions of consumers and investors around the globe, logic tells us no one can consistently predict where the economy and markets are headed. If the best football handicappers don’t perform much better than a coin flip when trying to predict what will happen when 22 players compete for just 60 minutes, how can we expect someone to accurately forecast the actions of millions of consumers and investors 12 months in advance?

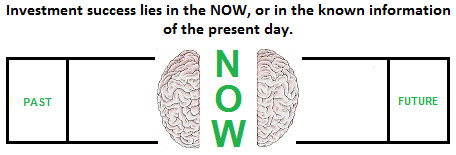

How Can The Now Help With Investing?

Would you rather invest based on a forecast with 50-50 odds or would you prefer to invest based on information known with almost 100% certainty? The future is very uncertain, but we can understand the current profile of the financial markets and economy with near 100% certainty.

What Are The Facts Telling Us In July 2017?

Given the future is highly uncertain, investment odds can be improved by allocating capital based on facts, and adjusting when the facts change. This approach relies on present-day facts, rather than uncertain forecasts of what may or may not happen. This week’s video looks at present-day facts and compares them to the facts near major bearish turning points. Even in the present-day context of ongoing concerns about North Korea, the Fed, and the economy, the video shows numerous examples of the power of staying in the now.

Was The Economy The Same In 2007 and 2009?

One method to stay in the “investing now” involves monitoring and adjusting. Do you believe there were discernible differences between the market’s technical profile when stocks peaked in October 2007 and when they bottomed in March 2009? Do you believe the known economic data was discernibly different before and after the financial crisis (October 2007 vs. March 2009)? If the answers are yes, then it is logical to assume there were discernible incremental changes in the hard evidence between October 2007 and March 2009.

1982: Would You Have Predicted An 18-Year Rise In Stocks?

If your self-talk is something along these lines, “Stocks cannot go up given all the problems in the world today”, then ask yourself how many people felt the same way in 1982?

The events below took place in 1982, or in the first year of an 18-year bull market in stocks:

-

- A brief but severe recession began in the United States.

- The Hama massacre began in Syria.

- Syrian president Hafez al-Assad ordered the army to purge the city of Harran of the Muslim Brotherhood.

- London-based Laker Airways collapsed, leaving 6,000 stranded passengers and debts of $270 million.

- The DeLorean Motor Company Car Factory in Belfast was put into receivership.

- The United States placed an embargo on Libyan oil imports, alleging Libyan support for terrorist groups.

- The Falklands War began: Argentina invaded and occupied the Falkland Islands.

- Argentina invaded South Georgia.

- A blizzard unprecedented in size for April dumped 1–2 feet of snow on the northeastern United States, closing schools and businesses.

- The nuclear submarine HMS Conqueror sank the Argentine cruiser General Belgrano, killing 323 sailors.

- Spanish priest Juan María Fernández Krohn tried to stab Pope John Paul II with a bayonet during the latter’s pilgrimage to the shrine at Fatima.

- Braniff International Airways declared bankruptcy and ceased all flights.

- Hussain Muhammad Ershad seized power in Bangladesh.

- The 1982 Lebanon War began.

- A rally against nuclear weapons drew 750,000 to New York City’s Central Park.

- The body of “God’s Banker”, Roberto Calvi, chairman of Banco Ambrosiano, was found hanging beneath Blackfriars Bridge in London.

- ASLEF train drivers in the United Kingdom went on strike over hours of work.

- Pan Am Flight 759 (Boeing 727) crashed in Kenner, Louisiana, killing all 146 onboard and 8 on the ground.

- Checker Motors Corporation ceased production of automobiles.

- The Reverend Sun Myung Moon was sentenced to 18 months in prison and fined $25,000 for tax fraud and conspiracy to obstruct justice.

- The Provisional IRA detonated 2 bombs in central London, killing 8 soldiers, wounding 47 people, and leading to the deaths of 7 horses.

- Torrential rain and mudslides in Nagasaki, Japan destroyed bridges and killed 299.

- In Beaune, France, 53 persons, 46 of them children, died in a highway accident (France’s worst).

- An attempted coup against the government of Daniel Arap Moi in Kenya.

- Italian Prime Minister Giovanni Spadolini resigned.

- Mexico announced it is unable to pay its large foreign debt, triggering a debt crisis that quickly spread throughout Latin America.

- Italian general Carlo Alberto Dalla Chiesa was killed in a Mafia ambush.

- Iowa paperboy Johnny Gosch was kidnapped.

- Lebanese President-elect Bachir Gemayel was assassinated in Beirut.

- The Lebanese Christian Militia (the Phalange) killed thousands of Palestinians in the Sabra and Shatila refugee camps

- In Israel, 400,000 marchers demanded the resignation of Prime Minister Menachem Begin.

- The 1982 Chicago Tylenol murders occurred when 7 people in the Chicago area died after ingesting capsules laced with potassium cyanide.

- Helmut Kohl replaced Helmut Schmidt as Chancellor of Germany through a constructive vote of no confidence.

- During the UEFA Cup match between FC Spartak Moscow and HFC Haarlem, 66 people were crushed to death.

- A gasoline (or petrol) tanker exploded in the Salang Tunnel in Afghanistan, killing at least 176 people.

- Cameroon president Ahmadou Ahidjo resigned, replaced by Paul Biya.

- Minneapolis Thanksgiving Day fire destroyed an entire city block of downtown Minneapolis, including the headquarters of Northwestern National Bank.

- The first U.S. execution by lethal injection was carried out in Texas.

- The December murders occurred in Suriname.

- An earthquake (Richter Scale 6.0 magnitude) in Dhamar, northern Yemen, killed at least 1,507.

- The United Freedom Front bombed an office of South African Airways in Elmont, NY and an IBM office in Harrison, NY.

- The United States Environmental Protection Agency recommended the evacuation of Times Beach, Missouri due to dangerous levels of dioxin contamination.

Investment Implications

The concept of staying in the now is based on probabilistic outcomes, or if you prefer probabilistic forecasting. Probabilistic forecasting is based on known information rather than where someone believes the data or markets will be in the future. When the “knowns” change, adjustments can be made in the now. As shown in the video above, the present-day facts still favor good things happening relative to bad things happening, which is reflected in our growth-oriented investment allocations.

Copyright © 2017 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM).

You might also like:

- Empower Yourself! How to Achieve Unlimited Success

- Do You Need to Know Financial Trends to Plan for Retirement?

- Cyberattack! Ransomware and The Future of Computing

- Auto Safety Trends

- The Evolution of Economic Warfare and the Oil Weapon

- Governments Around the World Outlawing Cash

- Retirees Working for Good