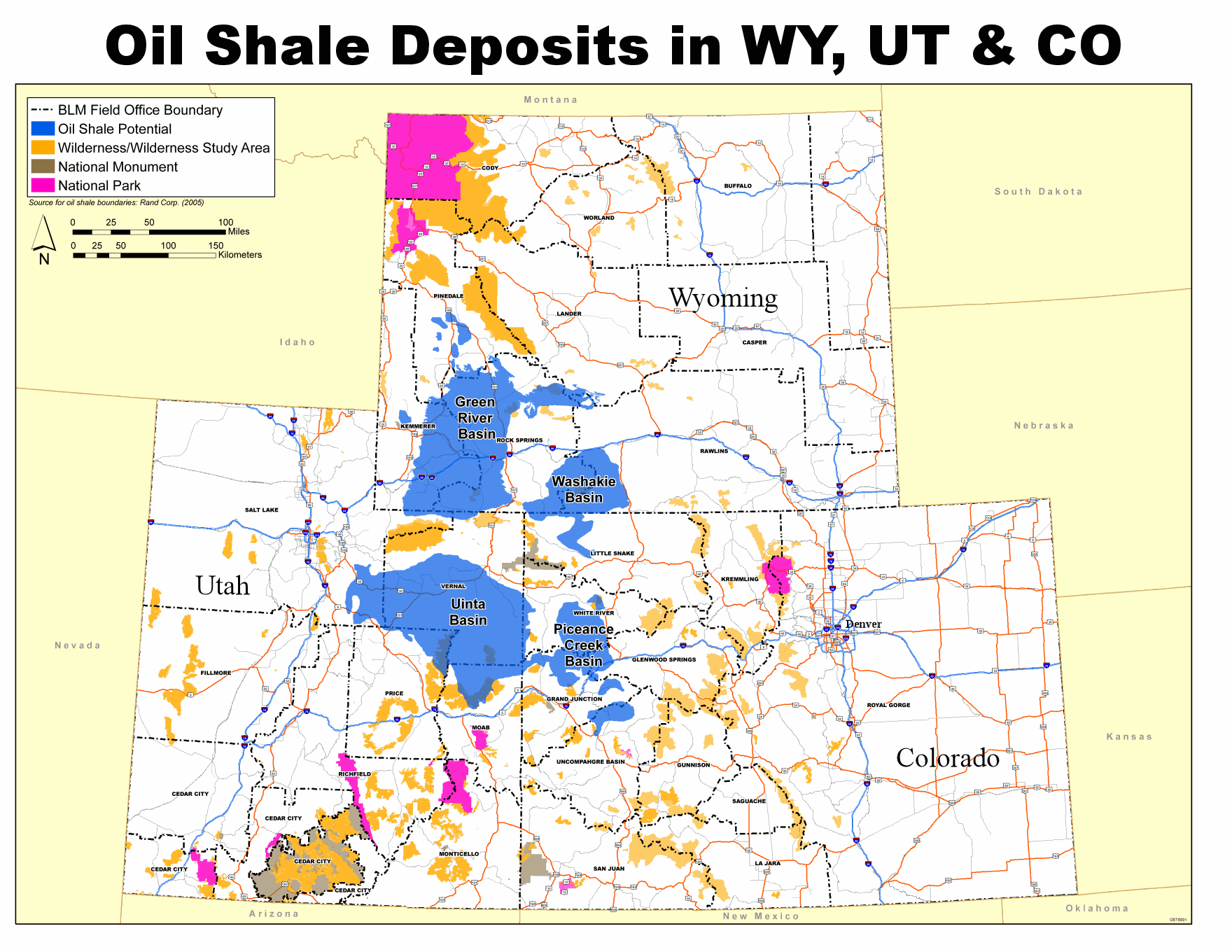

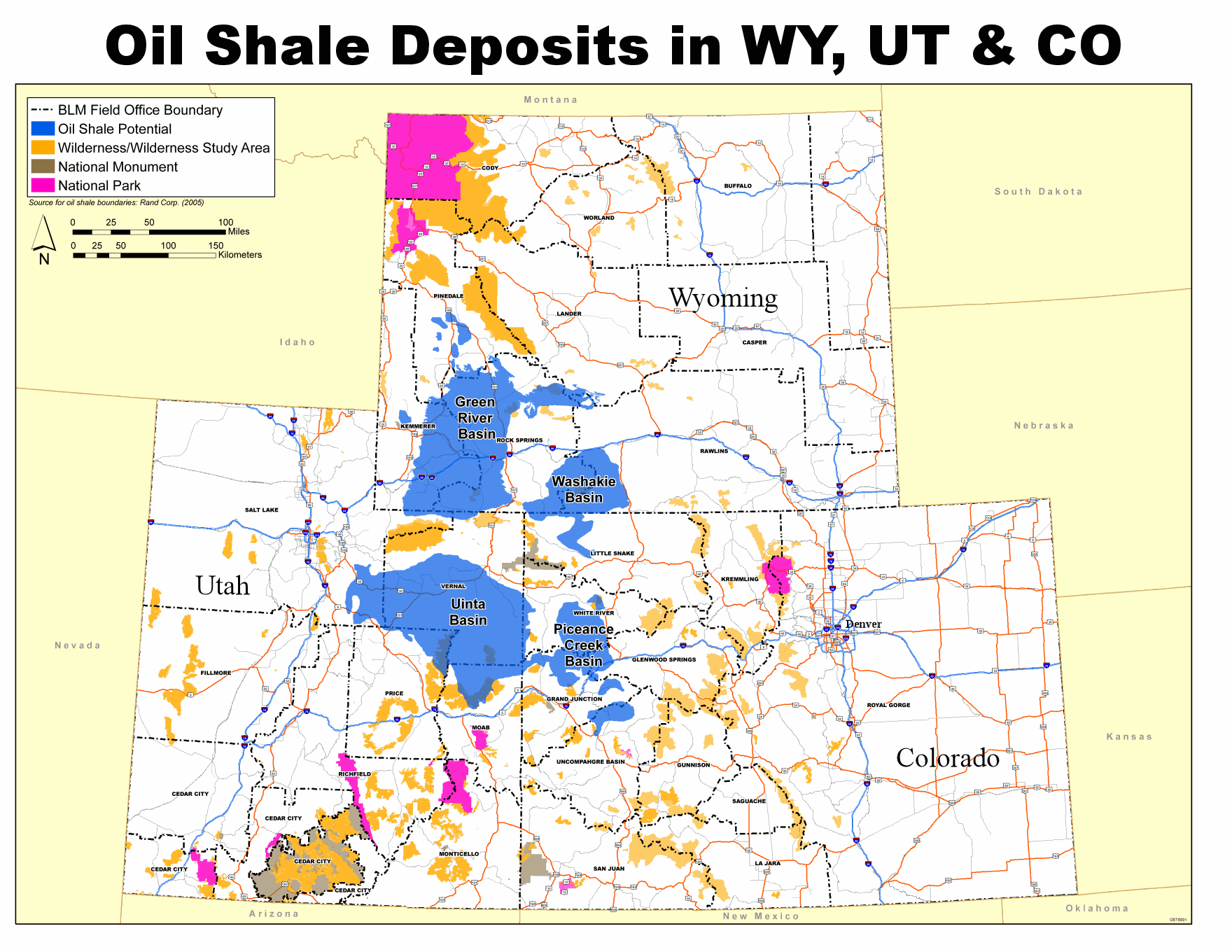

For as long as I can remember there has been big talk about the “Oil Shale” in remote places out West. According to Wikipedia “The largest oil-shale resource in the world is contained in the Eocene Green River Formation in Colorado, Utah, and Wyoming in three basins: the Piceance Basin, Green River Basin, and Uinta Basin. The Green River oil shales have been the focus of most efforts of the past hundred years to establish an American oil shale industry.”

The first attempts to exploit the Green River Basin shale deposit was made by the “Oil Shale Mining Company” way back in 1916. But oil from oil shale is notoriously uneconomical and hard to extract. Generally, the shale is mined and then heated to at least 300 °C (570 °F) to extract the oil, but it works better at between 480 and 520 °C (900 and 970 °F)! The usual process involves massive amounts of super-heated steam (which requires lots of water). The key to economical shale oil is not in locating the oil but in developing the right technology to make the process economical (and preferably environmentally friendly). In today’s article Charles Kennedy of Oilprice.com looks at a new method of doing exactly that. ~ Tim McMahon, editor

The Single Biggest Breakthrough In Oil Tech This Year

Utah holds the largest reserves of oil sands in the United States, but up until now, no company had the technology to exploit these vast resources. Despite the potential, “only a few companies are pursuing the price-sensitive and water-intensive development of the state’s oil shale and oil sand resources,” the EIA said in a 2017 report on the state, essentially writing off the region as a meaningful opportunity. But that could change in the very near future. Petroteq Energy hopes to bring the first commercially profitable oil sands production online in the United States in the next few weeks. “We have a very disruptive technology,” David Sealock, Petroteq’s CEO, told the New York Times in a sweeping profile of the innovative oil sands company. “There was a treasure chest here that didn’t have a key, and this technology is the key.”

Utah holds the largest reserves of oil sands in the United States, but up until now, no company had the technology to exploit these vast resources. Despite the potential, “only a few companies are pursuing the price-sensitive and water-intensive development of the state’s oil shale and oil sand resources,” the EIA said in a 2017 report on the state, essentially writing off the region as a meaningful opportunity. But that could change in the very near future. Petroteq Energy hopes to bring the first commercially profitable oil sands production online in the United States in the next few weeks. “We have a very disruptive technology,” David Sealock, Petroteq’s CEO, told the New York Times in a sweeping profile of the innovative oil sands company. “There was a treasure chest here that didn’t have a key, and this technology is the key.”

Unlike Canada’s oil sands, characterized by vast toxic tailings ponds and environmental destruction, Petroteq has pioneered a breakthrough approach to oil sands production that minimizes the environmental impact.

Petroteq uses a proprietary technology involving solvents that cleanly extract heavy oil sands by separating out the oil from the rock. Crucially, unlike destructive processes used in Alberta, Petroteq’s approach uses no water at all and does not pollute the soil. “What’s in Canada is an environmental nightmare,” Jerry Bailey, president of Petroteq, told the NYTimes. “With our operation, nothing goes in the air, nothing goes in the ground, and there is no water involved.”

The company crushes oil sands, mixes it with solvents, and spins the mixture in centrifuges. The process yields oil separated from the sand. The sand, free of oil and solvents, can be returned to the earth, while the solvents can be reused. The entire process makes a mockery of traditional oil sands processing, which involves vast quantities of water, chemicals, heat and toxic fallout.

On top of that, Utah would not have the same pipeline trouble that has plagued Canada’s oil sands. Producers in Alberta have proposed several pipeline projects that would essentially travel the length of the North American continent, several of which have been blocked at every turn, most notably TransCanada’s Keystone XL pipeline. Utah oil producers such as Petroteq wouldn’t have this problem. Petroteq sells its crude to local refineries, which can process the oil into diesel fuel.

On top of that, Utah would not have the same pipeline trouble that has plagued Canada’s oil sands. Producers in Alberta have proposed several pipeline projects that would essentially travel the length of the North American continent, several of which have been blocked at every turn, most notably TransCanada’s Keystone XL pipeline. Utah oil producers such as Petroteq wouldn’t have this problem. Petroteq sells its crude to local refineries, which can process the oil into diesel fuel.

These aren’t starry-eyed dreamers, but rather seasoned industry veterans. Sealock used to work for Chevron and two oil sands companies in Canada, while Bailey is a former ExxonMobil President.

They are starting small, but have huge ambitions. Petroteq has plenty of oil to work with, and the company is eyeing the 14 to 15 billion barrels of estimated oil sands reserves in Utah, plus more in the surrounding Rocky Mountain States. But, obviously, Utah is not the only place in the world with heavy oil sands. Petroteq wants to license its technology to companies in Australia, Colombia, Trinidad & Tobago and many other places.

The big question, though, is whether or not the company can make a profit. Petroteq claims it can breakeven with oil prices at just $32 per barrel, putting it on par with some of the most competitive shale basins in the U.S., including the Permian basin. And with WTI trading just below $70 per barrel, there is a large margin of error to work with.

Independent analysts are somewhat impressed, if guarded, about the novelty of the new technology. “The price is now in a zone where Petroteq can possibly justify what they are trying to do,” Kevin Birn, an oil sands expert at IHS Markit, told the NYTimes. “If the last decade has told us anything, I’d hesitate to rule out the potential for technology to generate new sources of energy supply.”

Petroteq is currently producing 1,000 barrels per day, with a plan to scale that up to 5,000 barrels per day in three years. To be sure, this is a relatively minor operation in the grand scheme of things, but it would likely spark broader investor interest, clearing the way for Utah’s oil sands industry.

This article originally appeared here and has been reprinted by permission.

Disclaimer:

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities.

RISK OF BIAS. OilPrice.com often owns shares in the companies they feature. For those reasons, please be aware that we are extremely bias in regards to the companies we write about and feature in our newsletter and on our website.

You might also like:

- Oil Price War: Saudi Arabia vs. Iran

- Coke, Meth And Booze: The Dark Side Of The Permian Oil Boom

- New Oil Cartel Threatening OPEC

- 3 Breakthrough Technologies Changing The Energy Sector