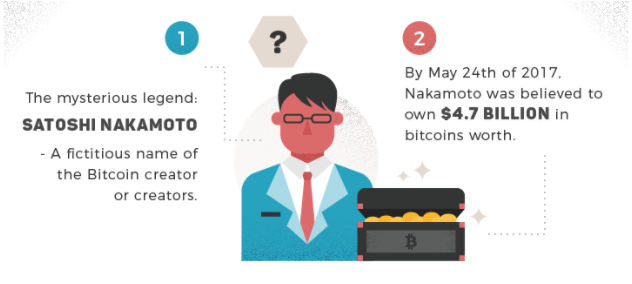

Although Bitcoin has been around for about a decade now it wasn’t until recently, that it has become fashionable and common knowledge. This year we’ve published several articles about Bitcoin and cryptocurrencies in general. Including Bitcoin: The New Safe Haven?, Cryptocurrency: Is Bitcoin the Future of Money?, and eCommerce Trends: What’s in Your eWallet? It seems like every time you turn around there is a new CryptoCurrency being created some of which have advantages over the original Bitcoin, some of which are just “Me Too” people trying to jump on the Bandwagon and others that are just outright scams. Today we will take another look at the Digital Currency Trend. ~ Tim McMahon, editor.

Will Digital Currencies Continue Shaping the Financial Market?

The last couple of years have seen several waves of popularity for digital currency, and as they continue to be adopted by more people and become more mainstream, it is important to consider how this technology will shape our world’s financial market in the years to come.

Therefore, in this article, backed by a couple of interesting facts provided by BitcoinPlay, we will proceed to talk about the main ways the digital currency trend will continue to impact the financial market.

1. Cheaper Payments

It has been estimated that by adopting blockchain technology, the world’s top 10 investment banks could save around $8-12 billion, which translates into lower commissions and transaction fees. By using bitcoin vs. a Credit Card processor, the middleman is cut out completely, hence on a worldwide scale, the yearly savings will be even bigger.

2. Instant, Cross-Border Payments

Perhaps one of the main disadvantages that people have when sending payments to other countries, is the long period of time before a payment is cleared. In the case of bitcoin, transactions are processed instantly, and only take a couple of minutes before they’re confirmed and saved forever on the public ledger (blockchain). This is a big difference when compared to the general 3-5 business days that a person has to wait before a bank payment is confirmed.

3. Money Security

All is not perfect with bitcoins. Losing your cash wallet is bad enough, yet losing access to a digital currency wallet can be disastrous, depending on the amount of coin being stored. Consider the case of James Howell who lost 7,500 bitcoins because he didn’t have a backup of his hard drive.

Since there is no way to recover a lost bitcoin address, many believe that a new platform of products meant to keep your bitcoin addresses and wallets safe will appear on the market. Additionally, features such as imposing limits on your daily spending via account settings may soon become a possibility as well. On the flip side, the lack of ability to recover a lost bitcoin address prevents someone else from stealing it through fraud.

4. Digital Currencies Acting as Reserve Coins

Bitcoin and other cryptocurrencies are still in their infancy, which makes them a lot less reliable when compared to fiat currencies such as the Euro (EUR), Dollar (USD), or Pound (GBP), etc. However, there are countries where the national currency lacks credibility due to irresponsible central bank actions or profligate money printing, resulting in massive currency inflation. Take the case of Venezuela for instance, where inflation has grown 128%, or the popular case of Zimbabwe, well-known for its huge inflation, and trillion dollar bank notes. In such regions, bitcoin and other digital currencies could turn out to be a lot more reliable, despite their volatile nature.

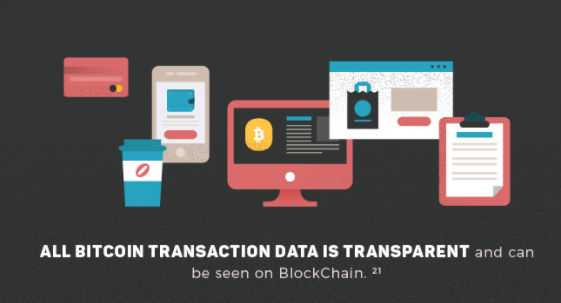

5. The Financial Field will Become More Transparent

Most digital currencies are based on similar principles, such as transparency, transaction recording, decentralization and more. By transparency we don’t mean that individual transactions are traceable, quite the opposite privacy is ensured due to the very nature of Bitcoins but the whole “Blockchain” meaning the amount of the transaction is visible, and the algorithm for managing it is well known and available for everyone to see. To continue to function, fiat currencies will need to adopt some of these principles as well, so we may soon be witnesses to new payment systems being developed by banks and governments. In return, this will also lead to fewer people being tricked by banks after signing contracts that they do not read or understand, and overall, fewer issues when it comes down to money in general.

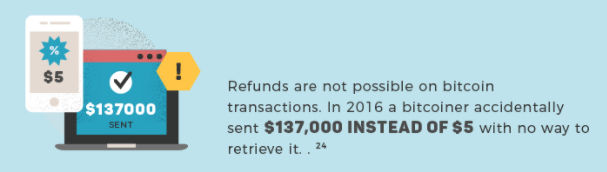

6. Government Free Currency

We’ve been exchanging currency from country to country for years, but imagine a financial system where the government does not control the supply of money. This could eliminate the spectre of government induced inflation and add a level of stability to the markets. But there are still hurdles to overcome. Currently there is no way to force a refund of bitcoins so it is up to the integrity of the receiver whether you get a refund or not.

7. Bitcoins are Energy Intensive

You would think that since bitcoins are purely digital they would require less energy to create than paper currency or even credit cards but because of the complex “mining” process of creating bitcoins and the fact that every transaction is mirrored throughout the entire ‘blockchain” one bitcoin transaction consumes 3,994 times more energy than a credit card transaction.

Based on everything that has been outlined so far, these are only a few of the changes that are likely to take place in the years to come, if digital currencies become a true driving force on the financial market. The trend is well-built now, it just needs time before mass-adoption is obtained.

All Images in this article are from an Infographic from Emerging Growth called 58 Insane Facts about Bitcoin and are used by permission.

You might also like: