Reasons To Remain Open To Bullish Outcomes For Stocks

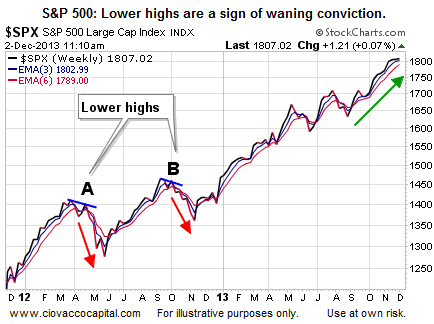

Any data that tells us to keep an open mind about better than expected outcomes must be confirmed by the stock market; something that has not happened yet. For example, if the stock market is to rally for the next few months in a surprising manner, that is not possible as long as the S&P 500 fails to make a higher high above 2,134. Our market model does not make decisions based on what “may or may not happen”. Therefore, the only real value to the table and video above is to help us remain open to and prepared for all outcomes (bullish and bearish). A few reasonable S&P 500 guideposts relative to improving bullish probabilities include 2096, 2107, 2116, and 2134. Each push above a guidepost level improves the odds for the bullish case. Below these levels, the expression “the market has some work to do” applies.

Reasons To Remain Open To Bullish Outcomes For Stocks Read More »