The Fed and “Plunge Protection Team”: Are They Manipulating Stocks?

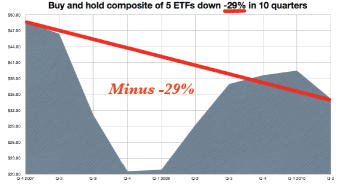

Rumors are, the U.S. government “is propping up the stock market.” By far, the most frequent question we’ve been asked recently is: “What is your take on the persistent internet chatter that the Federal Reserve is holding up the stock market via QE2, POMO, etc.? How can stocks ever decline again if the Fed […]

The Fed and “Plunge Protection Team”: Are They Manipulating Stocks? Read More »