Hyperinflation is not as uncommon as you think-

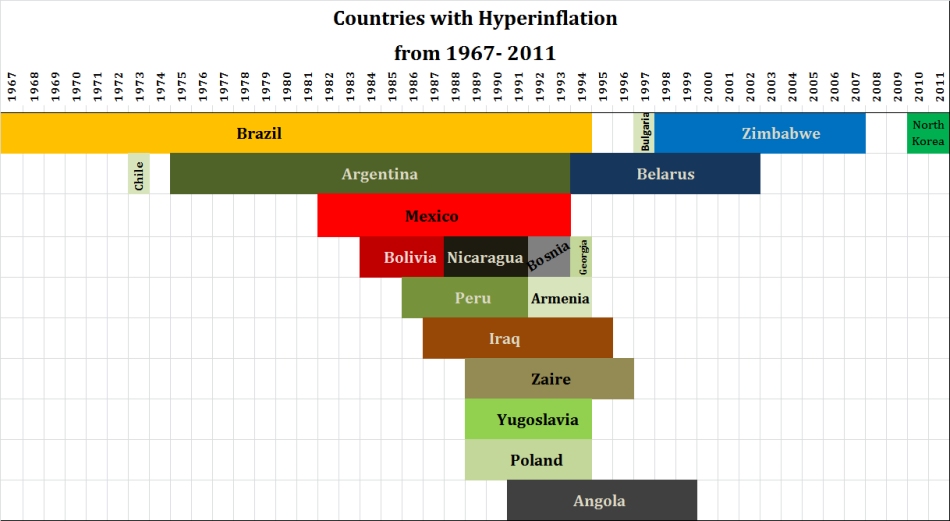

The most notorious recent case was in Zimbabwe and ran from 1998 – 2008. But North Korea experienced less severe hyperinflation in 2010 -2011. Other recent examples include Belarus 1994-2002, Bosnia and Herzegovina 1992-1993, and Angola 1991-1999. You can see a list of 26 examples of Hyperinflation beginning with Egypt in 276 AD which had 1 million percent inflation over 58 years and ending with Zimbabwe. And lest we Americans get too smug we need to realize that we are the only ones on the list twice. Once in 1779 and again in 1861-1865. The result of the Revolutionary and Civil wars.

As Richard McCue reminded us in a recent comment on our article How Does Gold Fare During Hyperinflation?

“Hyperinflation only occurs in countries where the government has already broken down. Weimar Germany was mired in a social Civil War… Zimbabwe never had a working democratic government and the increasingly bizarre action of the Mugabe dictatorship, crashing the economy, divesting the (white) professional farmers of their lands and intervening in the First and Second Congo Wars, converted very high inflation to hyperinflation. Greece’s hyperinflation is coincident with the German Occupation of WWII when there was no legitimate local government. Every incident of hyperinflation or extremely high inflation recorded occurs within the context of a crisis in government. A crisis serious enough to put the survival of the government at risk.”

This breakdown in society often resulted in a “Wild West” type of atmosphere.

In Germany,

The normally law-abiding country crumbled into petty thievery. Copper pipes and brass armatures weren’t safe. Gasoline was siphoned from cars. People bought things they didn’t need and used them to barter — a pair of shoes for a shirt, some crockery for coffee. Berlin had a “witches’ Sabbath” atmosphere. Prostitutes of both sexes roamed the streets. Cocaine was the fashionable drug.

Prices doubled during the 5 years from 1914-1919 but that was only the beginning.

But as it went on, things got worse, dentists and doctors stopped asking for currency, seeking payment in butter or eggs instead. Prices rose not just by the day, but by the hour — or even the minute. If you had your morning coffee in a café, and you preferred drinking two cups rather than one, it was cheaper to order both cups at the same time. From: Hyperinflation of Weimar Germany

How Do You Protect Yourself from Hyperinflation?

First, realize that hyperinflation does not materialize over-night. But that is not to say you should be complacent. The time to prepare is before times get bad. As we saw in Germany during hyperinflation any real commodity will have value while almost all paper assets will evaporate. During times of hyperinflation it is unlikely you will find a loan. Because the loan industry will probably disappear. Who will loan you $100 today if in two weeks when you pay it back they couldn’t buy a bar of soap? And even if they were to charge you an exorbitant amount of interest how would they know how much to charge? 100%, 1000% 1,000,000%? The problem with hyperinflation is the uncertainty.

During hyperinflation, if you already have a loan it is like a windfall. You can take your lunch money and pay off your house but obviously no one in their right mind is going to loan you any more money. So if you suspect hyperinflation on the horizon you could take out a loan and buy “real assets” almost any commodity would do, houses, gold, oil, whatever. Then at the peak of the hyperinflation when things are at their craziest you sell a small portion and pay off all your loans. Of course determining the peak like timing the stock market is a difficult proposition.

Gold the First Line of Defense

The first line of defense against hyperinflation that everyone thinks of is precious metals especially Gold. The key problem is finding someone who has enough goods to sell you. Recently an ounce of gold has ranged in price from $1200 to almost $2000. So if you had an ounce of gold and went to the grocery store you would have to buy a lot of groceries or accept your change in rapidly depreciating paper putting you back in a bad situation. You might be thinking, ahhh but by then maybe bread will cost $2,000 a loaf. Yes but in that case, since all commodities rise in a hyperinflation, an ounce of gold would probably be worth $2,000,000.

So the key with one-ounce gold bars or coins is to only use it for large purchases such as a house or car. For smaller purchases, you should have gold in smaller quantities such as 1/4 ounce or even 1/10th ounce. The way to think about it is that during a hyperinflation all commodity prices should increase relatively equally so whatever you could buy with 1 ounce today you could probably buy then. (Although at the current price gold may be a bit undervalued so let’s use the average price of $1500.) So would you take a $1,500 bill to the grocery store? Probably not. But you might use it to buy a big-screen TV and get 1/2 ounce in change. Better to have a 1/2 ounce in hand in the first place. In this scenario, 1/10th of an ounce would be about $150 or about right for a week or two of grocery shopping.

Silver is the Second Line of Defense

For smaller transactions, silver is much more convenient. And conveniently the government minted it in nice easily divisible denominations for many years. You can still buy “junk” silver coins. Which makes them very easy to use in emergency hyperinflation situations. Coinflation has a great chart that tells you the current silver value in each coin (based on date and the current price of silver). For instance as of this writing Silver is $19.37 an ounce and a 1921-1935 Peace Dollar is worth $14.9817. So if you had 10 of them in your pocket you could buy your $150 worth of groceries. So stocking up on “junk” silver coins is a great way to be prepared for a hyperinflation. And since a silver quarter is currently worth about $3.50 if you pay in silver you might still get Gasoline for 25 Cents a Gallon.

Diversification is the Third Line of Defense

It’s much safer for you not to hold everything in the country you live in. If hyperinflation hits one currency it doesn’t usually hit them all. Diversifying among a variety of currencies should lend some safety to your assets. Although during the period from 1967 – 1994 there seemed to be a rash of hyperinflation breaking out around the world, with at least one country experiencing hyperinflation in any given year during the entire period. And 1991 was especially bad with 10 of the 19 countries listed having hyperinflation in the year 1991. But even during the worst year, there were alternative currencies that were not experiencing hyperinflation. The notable exception was the deflationary years of 2008-2009 when the world experienced a massive liquidity crisis that reduced the price of virtually everything.

Typically the currencies of countries with commodity based economies like Australia, New Zealand, Brazil, and Canada do better during inflationary periods. And the traditional safe-haven currency, of course, is the Swiss franc. Recently the Northern European currencies like the Norwegian and Danish Krone and the Swedish Krona have been considered possibilities due to their newfound oil revenues. Of course, those living outside the U.S. have turned to the dollar at times when their local currencies have been in trouble. Although currently Argentina is trying (unsuccessfully) to prevent her citizens from exchanging Argentine Pesos for Dollars and it may end up with a second round of hyperinflation before long.

The Final Line of Defense

As we saw in the Germany example, copper and brass were also valuable. And during the Zimbabwe hyperinflation eggs, butter, milk and cooking oil were all prized commodities. The one problem with a breakdown in society is that of marginal utility. That is if there is no bread, milk, butter or cooking oil available you can’t eat your gold. So in very extreme cases, starving people might be willing to exchange an ounce of gold for a loaf of bread! So in addition to precious metals, which are useful up until the absolute worst cases, you should also stockpile useful commodities, such as canned food, grains and a grain mill, cooking oil, powdered or canned milk, etc. If you live outside a city and can produce your own food you will be that much better off during a hyperinflation. In Germany farmers suffered the least because everyone including doctors and dentists were willing to accept eggs or butter in payment. Other items that might be useful (and valuable) would be gasoline, oil (motor or heating), propane, guns and ammunition for hunting, and even spare car parts.

See Also:

- What is Hyperinflation?

- How Does Gold Fare During Hyperinflation?

- Confederate Hyperinflation Rates

- Zimbabwean Hyperinflation

- What is Marginal utility

- Gasoline for 25 Cents a Gallon